[via MarketWatch]

TEL AVIV, Israel, February 12, 2013 /PRNewswire via COMTEX/ -- Bioassociate has initiated coverage on Oramed Pharmaceuticals, Inc. ORMP -1.91% . The Initiation Report contains a detailed discussion of Oramed's business operations, market dynamics, macroeconomic data and indicators, financial results, potential cash flows, and risks. The Initiation Report is available at: http://www.bioassociate.com/research-and-publications/publications/ .

Via SeekingAlpha:

Oramed Pharmaceuticals Inc. (ORMP) is a public biotechnology company based in Jerusalem, Israel. Oramed develops an orally ingestible capsule for the delivery of protein-based therapies to the blood circulation through the gastro-intestinal (GI) pathway, with focus on treatment of diabetes. The Company's business model is based on advancing in-house R&D projects, based on its proprietary drug delivery system, up to mid-stage clinical development, following which the company will aspire to sublicense specific products to major players in the pharmaceutical marketplace.

The company's stock was traded in the OTCQB market until Feb 8, 2013. On Jan 22, 2013, Oramed announced a one for twelve reverse stock split in order to help it meet the qualifications for listing its shares on the Nasdaq Capital Market. Starting from Feb 11, 2013, Oramed's stock has been traded on the Nasdaq Capital Market.

Oramed Pharmaceuticals Inc. (ORMP) is a public biotechnology company based in Jerusalem, Israel. Oramed develops an orally ingestible capsule for the delivery of protein-based therapies to the blood circulation through the gastro-intestinal (GI) pathway, with focus on treatment of diabetes. The Company's business model is based on advancing in-house R&D projects, based on its proprietary drug delivery system, up to mid-stage clinical development, following which the company will aspire to sublicense specific products to major players in the pharmaceutical marketplace.

The company's stock was traded in the OTCQB market until Feb 8, 2013. On Jan 22, 2013, Oramed announced a one for twelve reverse stock split in order to help it meet the qualifications for listing its shares on the Nasdaq Capital Market. Starting from Feb 11, 2013, Oramed's stock has been traded on the Nasdaq Capital Market.

Oramed is advancing two clinical-stage programs:

ORMD-0801: Oral insulin for type 2 diabetes patients.

ORMD-0901: Oral GLP-1 receptor agonist type 2 diabetes patients.

A combination product for oral administration of insulin and a GLP-1 receptor agonist is in pre-clinical development.

· Oramed raised $5m on Dec 5, 2012 through a public offering, by issuing approx. 13.65 million shares at a price of $0.37/share (reflecting $4.4/share after reverse stock split).

· Considering the planned clinical development activities, the company's net cash should be sufficient for one year. We expect additional capital raising no later than mid-2013.

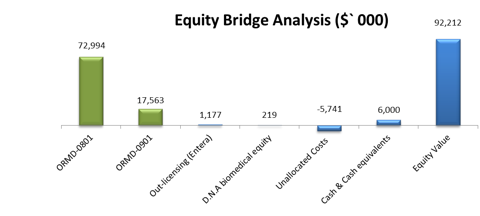

· We evaluate the company with $92.2m market cap with share price target of $12.8, representing a 38% upside to the stock's price on Feb 11, 2013.

Table 1: Equity Bridge Analysis

(click to enlarge)

Clinical programs

ORMD-0801: Oral Insulin Capsule for treatment of Type 2 Diabetes

Globally, there were an estimated 370 million people with diabetes in 2012, approximately 90% of them are type 2 diabetes (T2D) patients. In the US, diabetes affects an estimated 26 million people (only half of which are diagnosed), with 2 million newly diagnosed patients each year. While the disease is common in all regions, prevalence is highest in the Middle East, North America, and parts of Africa and Asia. About 80% of the diabetic population lives in developing nations. Around 40% of T2D patients (when their blood glucose levels cannot be controlled by diet, weight loss, exercise, and oral medications) must monitor their blood sugar levels through frequent measures of blood glucose and administer doses of insulin via injections or an insulin pump, multiple times every day.

Among T2D patients, resistance to injectable insulin has been identified as a major reason for clinical inaction and lack of achievement of target glycemic goals. Physicians, as well as patients, fear the complexity of insulin regimes and the chances of weight gain, as well as the necessity of a needle prick, associated with insulin therapy. Oral administration of insulin, in a manner that will involve it passing through the liver (e.g. absorption through the GI tract), would closely mimic the physiological pathway of insulin, may lead to an improvement of the insulin's therapeutic window, and would restore the insulin's physiological gradient. Currently, oral insulins under development are not poised to completely replace injected insulin, but to either postpone the initiation of insulin injections or to reduce the number of daily insulin injections.

Oramed's approach to oral insulin delivery includes incorporation of insulin to a carrier for providing protection of the insulin from degradation in the GI, and enhancing its passage through the inter-cellular junctions of the intestine into the blood circulation. Once the insulin reaches the blood, it is transferred though the hepatic vein to the liver. There, the externally-administered insulin is integrated into the physiological glucose-insulin cycle and compensates for the lack of naturally occurring insulin on demand.

Oramed's oral insulin treatment focuses on nighttime dosing in T2D patients with elevated fasting blood glucose (FBG) levels, prior to initiation of insulin injections. According to the company, the pharmacokinetic profile of its oral insulin capsule can optimally influence the excessive nighttime glucose production from the liver, which causes FBG elevation. If started early enough in the course of the disease, when patients have better pancreatic β-cell reserve (insulin producing cells), this approach may assist in controlling daytime glucose levels, reduce the strain on β-cells and potentially preserving their function, and may delay the requirement for injected insulin.

Pipeline competitive analysis

A plethora of technologies are being developed in the non-invasive insulin administration field. The different products under development (table 2) are targeted at different insulin-related applications, and do not necessarily aim at nighttime insulin administration for early-stage T2D patients.

Competition analysis

The technologies presented in table 2 can be primarily divided into three categories:

1. Direct competition to Oramed: These include the oral insulin delivery technologies, which all share the advantages of insulin absorption via the GI. Other than Biocon's IN-105, all companies that develop oral insulin are at an early stage of clinical trials. In 2011 Bioconreported a failure in a Phase III study conducted in India (not under FDA IND), and reported that it plans to continue the product's development.

2. Indirect insulin delivery competition: Most companies that develop inhalable, transdermal and transbuccal insulin delivery technologies direct them at the rapid insulin market. These products are designed to replace the insulin shots taken before meals, but not the basal (long-acting) or intermediate insulin injections, which are injected 1-2 times daily. These products may improve lives of diabetes patients by decreasing the number of daily insulin shots required, but do not pose a direct competition to Oramed's current proposed use of ORMD-0801.

Table 2: non-invasive insulin pipeline

| Drug | Company | Development stage | Remarks |

| Oral insulin | |||

| IN-105 | Biocon | Phase III | Failed Indian Phase III study. Company plans additional study. Bristol-Myers Squibb (BMY) has an option to commercialize worldwide. |

| Capsulin™ | Diabetology | Phase IIa completed | Diabetology signed a license agreement with USV to develop and commercialize oral insulin for the Indian Market. |

| Oral Insulin | Bows Pharmaceuticals | Phase I/IIa | Clinical trial suspended in 2010, no reports since. |

| Oshadi Insulin | Oshadi | Phase I completed | Clinical development not under FDA IND. |

| EMISPHERE™ Oral Insulin | Emisphere (EMIS.OB)/ Novo Nordisk (NVO) | Phase I completed | Administration four times a day. |

| NN1953 | Merrion/Novo Nordisk | Phase I completed | |

| Oradel insulin | Apollo Life Sciences | Phase I ready | |

| TrabiOral™ Insulin | Transgene (TRGNF.PK) | Preclinical | |

| Other insulin administration routes | |||

| Afrezza | MannKind (MNKD) | Phase III | Inhalable ultra-rapid insulin - for meal time only. |

| Oral-Lyn | Generex (GNBT.OB) | Phase III/ approved | Transbuccal ultra-rapid Insulin (direct delivery to the blood through the oral mucosa) - for meal time only. Approved in Ecuador and India. |

| U-Strip | Transdermal Specialties | Phase II/III | An external patch for transdermal insulin administration. |

| Midaform™ Insulin PharmFilm | MonoSol/Midatech | Phase I completed | Transbuccal Insulin |

| VIAtab™ | Biodel | Phase I completed | Transbuccal ultra-rapid Insulin (direct delivery to the blood through the oral mucosa) - for meal time only. |

| -- | Aerogen/Dance | ? | Inhalable ultra-rapid insulin - for meal time only. |

(click to enlarge)

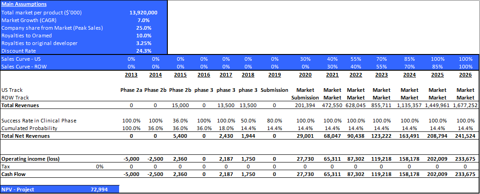

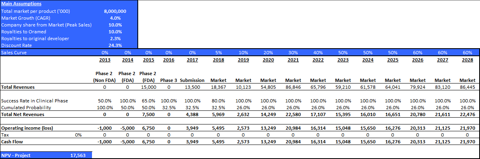

Valuation Methodology

R&D company valuations are complex due to non-cash valuation with a typically long time to market. Due to technological and financial uniqueness we analyzed Oramed with a pipeline assessment - this valuation is used for programs/companies prior to the market stage. The company's value is the total discounted cash flow plus unallocated costs and assessment of the future technological basis. The assessment of the future technological basis is established on the company's capability to "produce" clinical and pre-clinical projects every year and their feed rate potential.

Table 3: Main valuation parameters of ORMD-0801

| Territory | Potential Patients (000) | Current development stage | Success Rate Phase II | Success Rate Phase IIIa | Launch | Patent period |

| US | 6,000 | Phase II (non-IND) | 36% | 50% | 2020 | 2026 |

| ROW | 81,000 | 2021 |

ORMD-0901: Oral GLP-1 mimetic for treatment of Diabetes

Glucagon-like peptide-1 (GLP-1) is an incretin hormone - one of several enteric hormones that regulate gut motility, increase the secretion of gastric acid and enzymes, and stimulate insulin secretion by pancreatic β-cells. Guidelines for the management of hyperglycemia in T2D patients acknowledge the benefit shown by GLP-1R agonists over traditional oral anti-diabetics in reducing blood glucose.

Amylin's (AMLN) twice-daily Exenatide (Byetta) was the first GLP-1 mimetic, first approved in 2005 for treatment of type 2 diabetes adjunct to diet and exercise to improve glycemic control in adults, followed in 2010 by Novo Nordisk's once-daily Victoza (liraglutide). Bydureon, a once-weekly form of Byetta, was launched in February 2012 by Amylin, catalyzing its acquisition by Bristol-Myers Squibb. All current products are injected subcutaneously. The launch of Victoza boosted the GLP-1R agonist market size to $1.7b in 2011, as Victoza became a blockbuster in its second year on the market. Net sales of Byetta for 1Q 2012 reached $120m and for the same time period Victoza sales were $330m. In the US, GLP-1's have already taken up more than 5% of the overall diabetes market and this share is expected to grow to a significant number towards the end of the decade.

While GLP-1 mimetics prove efficient and have reasonable safety profiles, non-compliance, mainly derived from the need to inject the drugs and from GI side effects (mainly nausea), still affects about 30% of users, posing a major issue and influencing the potential benefit of the treatment. Consequently, ongoing efforts are made to enable more convenient delivery routes of GLP-1R agonists. These new delivery and formulation techniques will significantly help compliance and are expected to significantly expand the market share of GLP-1 analogues.

Similar Oramed's oral insulin product, ORMD-0901 is based on Oramed's oral delivery technology that provides protection from degradation of the peptide-based drug in the GI and facilitates its absorption into the blood circulation. ORMD-0901 is an oral formulation of a GLP-1R agonist, targeted by the company as a replacement for currently marketed injected GLP-1R agonists, with proposed advantages of easier, non-invasive, administration, as well as diminished nausea.

Competition

A major evolution of the GLP-1R agonist class is expected in upcoming years, driven by ongoing innovation around longer acting injected versions, as well as transdermal, oral, and nasal delivery routes. A third approach includes injected GLP-1R agonists in combination with insulin at a fixed ratio. Table 4 summarizes the most advanced clinical programs in each segment.

Non-GLP-1R agonist-related approaches for improvement of glycemic control in T2D patients include Dipeptidyl peptidase-4 (DPP4) inhibitors and Sodium-glucose transporter 2 (SGLT-2) inhibitors, both administered orally.

Table 4: Advanced GLP-1R agonists pipeline

| Drug | Company | Development stage | Remarks |

| Longer acting GLP-1 analogues | |||

| Albiglutide | GlaxoSmithKline (GSK) | Phase III completed | Once-weekly injection. Less efficacious than approved GLP-1's but exhibited a better safety profile |

| Dulaglutide | Eli Lilly (LLY) | Phase III | GLP-1 analogue fused to Fc antibody fragment; once weekly |

| Exenatide-QM | Phase III | Once monthly subcutaneous injection of Exenatide | |

| Semaglutide | Novo Nordisk | Phase III ready | Once-weekly human GLP-1 analogue |

| ITCA-650 | Eli Lilly / Intarcia Therapeutics | Phase II completed | An implantable device - inserted subcutaneously to provide continuous and consistent delivery of exenatide for up to a year. |

| LAPS-Exendin | Hanmi Pharmaceuticals | Phase II | Long-acting Exendin-4 analog - once weekly/monthly administration |

| Non-invasive delivery | |||

| NN9924 | Novo Nordisk / Emisphere | Phase I | Oral formulation of a GLP-1 analogue peptide |

| NN9926 | Novo Nordisk / Merrion | Phase I | Oral formulation of a GLP-1 analogue peptide |

| NNC 0113-0987 | Novo Nordisk | Phase I | |

| ZYOG1 | Zydus Cadila | Phase I | Oral formulation of a GLP-1 analogue peptide |

| Combination products | |||

| IDegLira (Insulin

Degludec /liraglutide)

| Novo Nordisk | Phase III | Fixed ratio combination of ultra-long acting new generation insulin + recombinant GLP-1R agonist. |

| Insulin Glargine /

Lixisenatide

| Sanofi-Aventis (SNY) | Phase II | Fixed combination of insulin and GLP-1 peptide in a single pen device |

Competition analysis

The GLP-1R agonists market is expected to grow in upcoming years, but this growth will be accompanied with increased competition, as additional products are expected to reach the market. The benefit of an orally available GLP-1R agonist compared to the currently marketed injected products is clear. However, this advantage will be weakened compared to future products that will allow a monthly injection. Patients that are injecting long-acting insulin will benefit from the fixed insulin/GLP-1R agonist combinations that are expected to reach the market.

Table 5: Main valuation parameters for ORMD-0901

| Territory | Potential Patients (000) | Current development stage | Success Rate Phase II | Success Rate Phase III | Launch | Patent period |

| Global | 100,000 | Phase II (non-IND) | 50% | 65% | 2018 | 2028 |

Out-licensed Oral treatment of osteoporosis

In June 2010 Oramed entered into an exclusive out-licensing agreement with Entera Bio Ltd. for the development of oral delivery of drugs for certain indications. The out-licensed technology differs from Oramed's main delivery technology, used for its oral insulin and GLP-1 analog and is subject to different patent applications. Under this agreement, Oramed is entitled to receive royalties of 3% of Entera's net revenues from the product. Entera's initial development effort is focused on a treatment for osteoporosis.

Table 6: Main valuation parameters

| Territory | Current development stage | Success Rate Phase II | Success Rate Phase III | Launch | Patent period |

| Global | Phase II (non-IND) | 50% | 65% | 2019 | 2028 |

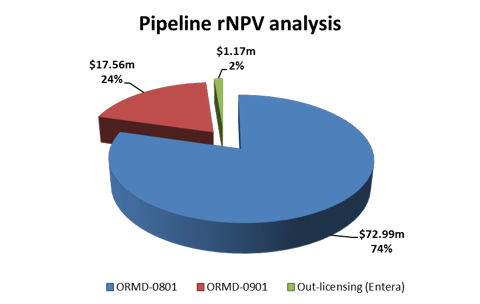

Table 7: Pipeline analysis Summary

Valuation summary

Oramed`s assets are the ORMD-0801 and ORMD-0901, as well as royalties from Entera's product, which is developed based on Oramed's delivery technology. The deal with Entera also entitled Oramed equity in Entera's parent company, D.N.A biomedical, which is a public Israeli company, listed on the Tel Aviv Stock Exchange (TASE). Oramed holds 4.71% of D.N.A equity, which is valued at $0.2m as of Feb 11, 2013.

We estimated the company`s pipeline assets without unallocated costs, such as G&A costs, which are not directly related to any specific asset. The G&A costs, based on the last quarter, were in an annual rate of ~$1.4-1.6m capitalized for the same time period as the pipeline analysis. We assumed 4% growth in those costs each year, capitalized as of Feb 11, 2013.

We evaluate the enterprise value at $86.2m as of Feb 11, 2013 as presented in table 10.

Table 8- Pipeline valuation analysis ($, 000)

| Pipeline Analysis | rNPV ($, 000) | |

| ORMD-0801 | 72,994 | |

| ORMD-0901 | 17,563 | |

| Out-licensing (Entera) | 1,177 | |

| Total rNPV Pipeline | 91,734 | |

| D.N.A Biomedical equity | 219 | |

| Unallocated Costs | -5,741 | |

| Enterprise Value | 86,212 | |

Equity and stock price valuation

The company has no loans and has ~$6.6m as of Nov 30, 2012. In the current status of clinical trials, the monthly "burn rate" is ~$0.25m-0.3m. As of Feb 11, 2013, we estimate $6m cash and cash equivalents.

Table 9 - Equity valuation and price per share ($, 000)

| Enterprise Value | 86,212 | |

| Non-operational Assets/Liabilities: | ||

| Cash & cash equivalents | 6,000 | |

| Total non-operational assets/liabilities | 6,000 | |

| Equity Value | 92,212 | |

| Number of shares (000) | 7,209 | |

| Price per share | 12.79 | |

Upcoming Potential Catalysts

| Program | Event | Significance | Timeline |

| ORMD-0801 | Initiation of Phase IIa under IND | Medium | Q2/2013 |

| Completion of Phase IIa | High | Q1/2014 | |

| Initiation of Phase IIb | Medium | Q4/2014 | |

| Completion of Phase IIb | High | Q3/2015 | |

| ORMD-0901 | Initiation of Phase IIa (non-IND) | Low | Q1/2013 |

| Completion of Phase IIa | High | Q4/2013 | |

| Initiation of Phase II under IND | Medium | Q2/2014 | |

| Completion of Phase II | High | Q2/2015 |

Full report can be found here.

No comments:

Post a Comment